Understanding Interest Accumulation

What Compound Interest (Usury) can do to an Economy

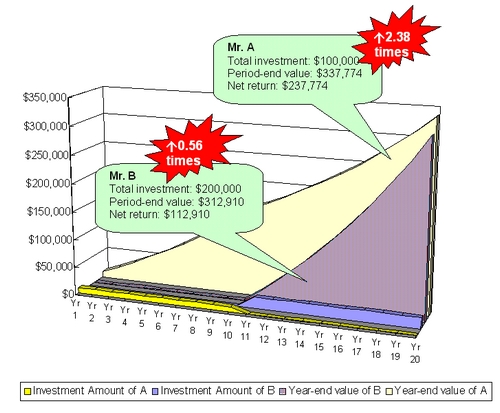

Let us look at how compound interest can impact an entire economy. We begin by looking at a few examples and then apply that to a wider base where more than one mortgage is issued. In fact, there are some real examples in recent history where things spin out of control. Let us look at a case of ten million mortgages that are foreclosed in a period of a few years to measure accumulated impact. Most of these were the result of variable rate interest (usury) on the loans that triggered the sub-prime crisis of late 2008. Most people who bought into these attractive offers started with low interest, but as real estate prices surged, value for homes increased and the interest (usury) rates were adjusted beyond the reach of those who were still paying the non fixed variable rate mortgages. For the sake of simplicity, we will not be considering fractional reserve lending and leveraged derivatives in this scenario. We will be looking at debt swaps and buyouts.

Given a $10,000 loan to be paid down in 10 years at 9% interest (usury) compounded annually, the amount that will be paid and is paid back in full is $23,673.64 of which $13,673.64 is interest (usury) that has been paid out over the 10 years of the payback period. Let's look at the same loan at 19%. The figures in this case are $56,946.84 for the total and $46,946.84 as interest (usury) paid out. Finally, lets look at the same loan but paid out over 20 year at 19% interest (usury) as before. The figures in this case are $324,294.23 for the total paid out and $314,294.23 of that is interest (usury) accumulated and compounded annually over the whole period (1). In the latter case, the amount of accumulated interest (usury) amounts to some 31.4 times the original principal

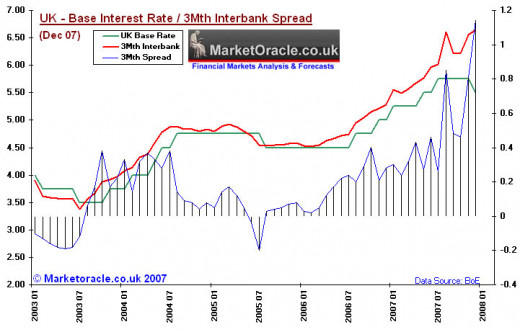

Let us now look at a mortgage for $200,000 over 30 years at 9% interest. The total paid out before deed clear and free is granted to the buyer, will be $2,653,535.69 of which $2,453,535.69 is interest (usury). On the original $200,000 mortgage, the lender has recouped the entire loan, but more than 24 times that in accumulated compound interest (1). This is just the case for a single mortgage. Some mortgages are less both in the amount of the loan and interest, but many are far more, especially for large office and apartment blocks. Suppose the rate charged is a prime lending rate, such as bank to bank for a debt swap. For the case of the $200,000 mortgage at 2% interest, the figures for the full amount paid out and the accumulated interest, these are $362,272.32 and $162,272.32 respectively. Almost no one gets a mortgage or a loan at such a low rate. This is more typical of inter bank lending. Higher rate interest (usury) is offered to the typical home buyer applied against the collateral of the home in the case of the secured loan. But bankers have been caught interest (usury) rate fixing between themselves and this has resulted in defrauding everyone with artificially rigged interest (usury) rates to obtain higher profit. This is known as the LIBOR scandal (4) and we will look at this a little later in detail after we do more analysis on basic rate differences.

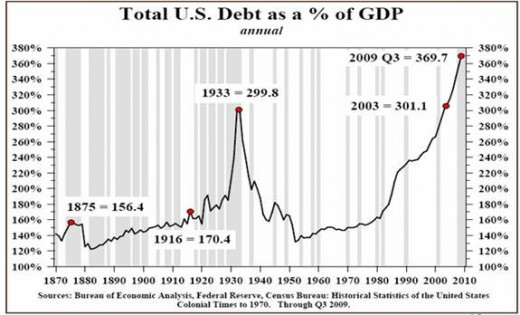

It follows that larger banks will issue huge loans to smaller banks at low interest. These days that amounts to anywhere from 0 to 2%. This fund of loan principle is then divided up among millions of home owners through thousands of local banks at higher interest (usury). To keep it simple, the big lenders lend at 2% to smaller lenders and the smaller lenders in the chain lend at 9% over 30 years. In the first case where the big lender extends bulk loans to thousands of smaller lenders for ten million mortgages, if these were all paid back by the smaller banks, then the amount paid with interest (usury) would be 10,000,000 times $362,272.32, which gives us the astronomical sum of $362,272,320,000. A mass default would mean a loss of much of the interest which itself would amount to $162,272,320,000. But the larger banks are somewhat protected by such a loss as the smaller lenders charge higher interest at 9% in this case, The loss across the bottom would be much higher amounting to $2,653,535,690,000 and $2,453,535,690,000 respectively. Notice that the interest (usury) part is much larger further down the scale. Ten million defaults leads to a loss of trillions of dollars. But this is simplified because, loans will be at various stages of being paid off. However, over 10 out of the 30 year life of a mortgage, not that much of the principal will be paid as most of the payout will be in interest (usury). It can be said, especially in relation to the Sub-Prime event, that close to 2.5 trillion was lost by those who defaulted on their mortgages. The banks really lost very little owing to the fact of all the interest (usury) collected prior to default and foreclosure and the banks held the collateral, even though depreciated by a glut and labelled as toxic assets. What losses there were, were covered by insurance companies like AIG. Then there were bailouts by the Federal Reserve when big banks got into trouble. That was just in the housing sector!

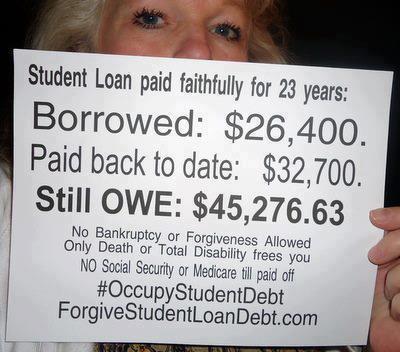

The larger banks are spared much of the cost due to their lower interest rates and the payback of loans by smaller banks that charge higher interest (usury) to the consumer. Banks also began to package mass amounts of mortgages by category and sold them to unsuspecting customers via the stock exchange and one another. Nor are the loans limited to mortgages. There are also car loans, student loans, construction loans, credit cards, revolving loans and many more. These too, especially the revolving loans and credit cards, gather the most by way of interest income for the lenders. The banks actually prefer that the credit card holder and the revolving debt holder carry a balance upon which compound interest is charged. Say that the average person holds about $20,000 in revolving debt or credit card balances. Most credit card interest rates are fixed at 9 to 23% interest. They are also, for the most part considered to be non secured loans as they can be used for non collateral items like restaurant meals of food from the shopping market. There is no way banks can get a bailiff to seize these kinds of items. Nor can a bailiff seize on a defaulted student loan. How can an education be foreclosed, unless of course an earned degree is rescinded? But to do that, would be counterproductive as the graduate would not be able to get a job, even though that is next to impossible even with a degree. But, back to our credit card debt that is at $20,000 at 19% interest. In this case, the holder carries a balance but decides to quit cold turkey and pay down the credit card. Based on minimum payments at a fixed rate when they are at the maximum threshold over 20 years, the card holder faces the following daunting task. $648,588.47 is what the total credit card debt will cost if paid in full. The compounded interest (usury) will amount to $628,588.47 (1). That's more than 1/2 a million dollars! The holder would have to pay $2,702.45 a month averaged out to pay it down. For most people, this is impossible, so the minimum allowed payment is made, stretching out the repayment indefinitely into the future and increasing the compounded interest. For example. The same credit debt over 40 year results in the following. The total amount balloons to $21,033,350.13. Yes, for a $20,000 credit card debt, the total payout is now over 21 million dollars. This is nearly a thousand fold increase in the debt. We can see why it is in the best interest (usury) of the card holder to pay off the entire balance in the grace period. Most people do not pay off the entire debt in the grace period, but carry a balance that adds, adds and balloons. Available figures for the US, put collective credit card debt at over $800 billion. At standard 19% interest over 20 years, the sum total collectible would amount $25,943.54 billions, or almost $26 trillion dollars. Added to the mortgages above, that total is now $28.6 trillion and growing. Add in student loans, car loans and more, the figures begin to look astronomical. The bulk of this figure is “unsecured loans”; money that can never be paid back, but continue to accrue as long as there is no default. When defaults happen, all bets are off.

Student loans are another kettle of fish altogether and have recently been the inspiration of two major protest movements in the last year. In a March 12th, 2012 article in the Wall St Journal (2), student loan debt topped $1 trillion at the end of 2011. Interest was set to double to 6.8% in the summer of 2012, but an eleventh hour deal managed to keep interest at 3.4% (3), which if we have been paying attention would cost plenty as it is. Let us look at a fictitious $10,000 student loan paid off in 20 years at 3.4% interest. The sums then for the total and the interest are, $19,516.9 and $9,516.9. This is not so bad and compares to bank to bank rates. But the total for the combined debts now reaches $1.95 trillion to the growing debt burden. Added to the above, we have over $30 trillion for these three venues.

Total mortgages in the US (5) and total assets US combined equal a staggering $188 Trillion (6). It is easy to see that the accumulated interest over the life of these loans at various stages of being completely paid would likely exceed a quadrillion dollars. At least one source indicates that the sum of money spent on war since WWI to the end of the Vietnam war was a quadrillion dollars US. As compound interest balloons out of control, there comes a point where an individual or entire countries are unable to keep up with even the interest payments. Whole countries have been known to default, but how does an entity like the IMF foreclose an entire country? Iceland had some solutions that came out of the general assembly of the entire population.

Just as large banks exist to profit by charging interest (usury), so do small banks and the idea of rate fixing to drive up profits is a device to convince larger banks to lower interest (usury) rates to the smaller lender banks (7). If this works, then the smaller banks that charge higher rates for loan customers for secured and unsecured loans, credit and debt will reap more profits if the larger loaners like Chase Manhattan and the Federal Reserve lower their rates. But even the larger banks answer to the International Monetary Fund (IMF) and the World Bank. It is not even unheard of for the very large loaners to charge 0% interest in a bid to get customers during a recession or depression. The very largest banks thus waive the use of interest (usury) by employing this tactic and the smaller banks end up keeping all the profits from interest (usury) as they never lend at 0%.

Debt swapping and buyouts is another tactic used to generate profit. High interest (usury) loans though risky, are an attractive option that big risk taking spenders sometimes speculate upon in order to accrue more profit based on the high interest (usury). These are often bundled together in massive packages, such as the sub-prime variable mortgages were that led to the sub-prime collapse that began with Lehman Brothers in the fall of 2008. The speculation did not end there and is still ongoing. There is a linkage between large international banks, national, regional, fast loan chains and debt collection agencies. The lower one descends from the top, the higher the rate of interest (usury) and the more risky the investment and greater the danger to the user of such services.

To get a clearer picture of reality versus the heady world of high finance, we need to look at concepts such as fixed capital and variable capital such as collateral assets like all forms of production machinery, houses, farms, mines, fishing fleets, shipping, planes, transport and real estate versus variables that we find in currencies, credit cards employment and speculative investments respectively. Collateral is the fixed capital that is based on something tangible like real estate, a house, apartment block, mall, office tower, ship, truck, mine or a farm. It is something that a bank can place a lien on in the event that the loan is defaulted and the bank can take seize and possession in lieu of full payment of the loan. This is what is defined as a secured investment. On the other hand, variables like floating currencies, employment, education, revolving credit and credit cards are insubstantial, often not based on anything tangible and cannot be collected in the event of a default. Some non-secured investments are less risky than others. The ones that are the highest risk are non-secured student loams, revolving credit and credit cards. Another term for these is non-collateral loans.

Collection agencies and debt buyers are connected with banks and interestingly, do not buy debts, pennies on the dollar as popularly believed. They are often contracted by banks to collect on defaults like on credit card and revolving credit defaults. They are a business to business link to act on behalf of their employer, the banks to collect by pressuring the lender by a multitude of techniques. `Collection agencies and debt buyers are undeniably linked, regardless of their differences. In fact, many debt buyers forward their accounts to collection agencies to work on a contingency basis. Also, they do basically the same thing for credit originators (return value of non-performing credit accounts). They just go about it in a different way. Collection agencies and debt buyers often compete against one another for shares of banks’ charged-off debt portfolios. Collection agencies want the work farmed out to them while debt buyers want the banks to sell them the debt. `(8) Some people wonder why anyone would want to buy debt. The answer is somewhat the same as the inquisition of `toxic assets` insofar that toxic assets are collateral that has devalued due to a glut on the market due to mass default. The difference lies in the fact one retains value due to being substantial and the other is speculative based on the ability of the collector to enforce the collection of a non-secured debt. The two merge when we consider that all promissory currency notes and loans are based on an agreement to give something substantial by way of a real commodity in place of a virtual commodity in the form of money that can be used to trade for something other commodity that is substantial. In short, it takes work in the physical world to produce collateral and that can be traded for a virtual commodity in the form of money or a collateral based secured loan. This collateral backing can then be used to acquire something more substantial like a home of business. This also involves what is called fractional reserve banking or lending. Upon all of this mediated by banks, there are service charges and interest (usury).

Lenders are constantly on the lookout for ways to generate profit through interest. Among the opportunities that present themselves is the field of combat between countries competing to be dominant on the imperialist scene for the acquisition of resource loot. War and interest work in tandem not for collateral that is damaged and destroyed in war and is referred to collateral damage, but for the future collateral that comes out of resource production by actual labour creating substantial collateral upon which the banks can speculate. War is highly profitable on both sides of the bankers' equation as to the winner goes the spoils and to the loser goes redevelopment contracts at interest. The tools of war require a lot of investment and in turn generate plenty of compounded interest return.

As the US faces the fiscal cliff in early 2013, we have to recognize that almost all of it was generated by compound interest on all those billions of floating loans, whether on the sum of real estate and production or the costs of research and development for the theatre of war. Big lenders are not shy to lend to risky ventures such as war and on both sides of the battle. Hitler would never have attained the heights of power without powerful financial backers. Has the Third Reich survived into the present, there is little doubt that it would be also facing a type of fiscal cliff. The interest driven economy is faced with the inability to pay down the debt due to constantly increasing compound interest and so instead of going deeper into trouble, austerity is applied to that sector of the economy that generates no solid collateral. This means Medicare, Social Security and welfare programs face the chopping block while collateral based economics continues as before. The solution is not to constantly raise the debt ceiling as this would have to be done over and over until it becomes clear to absolutely everyone that this will not work when the currency becomes worthless. This scenario occurred in Germany in 1929-33 where the Reichmark collapsed in value until being virtually worthless due to over riding conditions of the Treaty of Versailles. It took Hitler and the Nazi party with financial backers to turn the situation around. The cost was to end in WWII, upon which the bankers also invested and profited. Europe has responded with austerity and the people are in turmoil. The US will eventually be forced into the same agenda when the debt ceiling reaches a point where debt financing dives into negative territory. That means the US will reach the point where the total GDP will not be able to generate sufficient collateral to service the interest on massive debts. The only solution is to eliminate interest (usury) altogether, but it won't be the bankers that do this as already indicated by the experience of Iceland.

References:

-

http://online.wsj.com/article/SB10001424052702303812904577295930047604846.html

-

http://www.guardian.co.uk/world/2012/jun/29/congress-student-loans-interest-rates

-

http://www.federalreserve.gov/releases/z1/current/accessible/l217.htm

-

http://rutledgecapital.com/2009/05/24/total-assets-of-the-us-economy-188-trillion-134xgdp/

-

http://www.forbes.com/sites/insidearm/2011/06/08/do-you-know-what-a-collection-agency-does/