Repercussions from the US recession on the rest of the world

Although some of these pictures are fictitiousm they get the point across about the collapsing economy.

The 2008 financial collapse has led to severe reprocussion still reverberating around the world

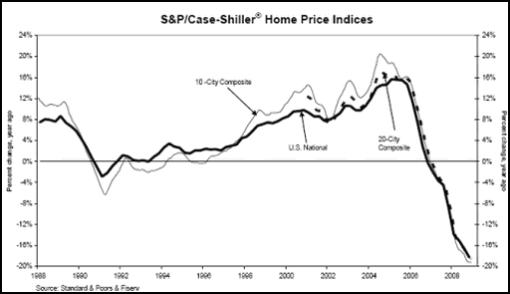

The watershed of the collapse of the sub-prime mortgages starting in the spring of 2008 and ending in Sept. 2008 with the disappearing of Bear Stern, the fall of Lehrer, AIG and the near collapse of J P Morgan and eight other major banks that led to massive bailouts from the Federal Reserve, has had a huge reverberating impact around the world. World stock market collapsed and went into free fall. Millions of people lost their jobs in the US, China, India, Africa, Asia minor, Canada, the US, Europe and Russia among others. The subsequent tightening of loans has frozen credit to large businesses and small as well as to potential new home owners. The credit market has tightened and combined with the threat of deeper unemployment and has caused a collapse of consumer confidence and spending. That loss has been seen for the Christmas season of 2008. Less sales of goods like electronics and cars, means that there is no new production due to a backlog and a crisis of overproduction. More job losses ensue which reassures no one and so the whole thing spirals. That was then, but now, the economies of China and India have gone back to being the growth economies of the world. Meanwhile, the European Union is undergoing its own financial crisis in 2010 with austerity for everyone that is creating civil unrest.

In China, some 20 million people have lost their jobs in the Capitalist sector as of February of 2009 and more since then. The Chinese government has basically ordered the US to get their financial house in order. China is also posturing in a threatening manner, at least implied due to the US influenced collapse of a large portion of their market. What has saved China from a total meltdown is the fact that they by and large maintain a planned economy and some two thirds of the population still farm unlike in the US where only two percent farm. The Chinese invested in and held a large amount or US based funds and monies and were directly impacted by the loss of value due to the meltdown.

A sudden surplus of repossessed homes meant a grinding halt on most new construction, drying up lumber sales from Canada and within the US, a subsequent loss of lumber jobs and supporting jobs like transport. The US and Canada have always been in competition over lumber products due to domestic supplies versus cheaper ones from Canada. Tariffs and protectionism have been more often the norm. Now there is very little market left for Canadian lumber with the loss of jobs and a tightening in the Canadian market as a result.

The meltdown of the markets subsequent to the sub-prime mortgage, market and financial collapse in the US triggered off a series of bank failures around the planet affecting every country. Only Canada was spared bank failures however, the Bank of Montreal was the recent recipient of a $1.1 billion bailout from the US. In Iceland, the economy completely collapsed and drove the whole population into desperation. Britain had a run on the banks unseen since the great depression beginning in 1929. Not even Switzerland, the haven for foreign based deposits including from the US did not escape unscathed. In France there have been two general strikes in 2009, protesting wage cuts and job losses. Greece has had numerous strikes due to the austerity measures imposed by the EU and IMF.

The auto market also dried up and new cars started piling up everywhere they could be placed. Car sales overall fell by 80 percent within the US and Canada, which led to massive layoffs and a call by big manufacturers like GM for bailouts to keep from going bankrupt. Car sales to the US from Japan also dried up and massive layoffs occurred there as well. In Addition, Japan held a lot of US stocks and currency and sought to dump them as quickly as possible. Japan also lost a lot of export sales of electronics as consumer spending contracted in the US due to the credit crunch. In fact, since January of 2009, there have been more than 5 million new applicants for unemployment benefits in the US; a huge short term increase in unemployment.

Raw resource economies like Africa suddenly have no markets as the economies that demand them for manufacturing needs like cars and technology, no longer need them in a collapsed economy where there is no market for cars and technology. This has led to massive lay-offs in mines in the Congo and other areas where metals like copper suddenly have a poor market. Copper prices and the prices of other rare metals collapsed and there was no profit in them until 2010 when demand from China started to increase again. In the recent past (Sept. 2008), copper fetched such a high price, that the poor were breaking into buildings and power centers, just to steal the copper for resale as scrap metal destined for China's booming market. The result is mine closures all over Africa and mass lay-offs. Africa is a poor nation to start off with and poverty is now re-intensifying. This sets the stage for a lot of unrest in the area as people now have to return to squalor.

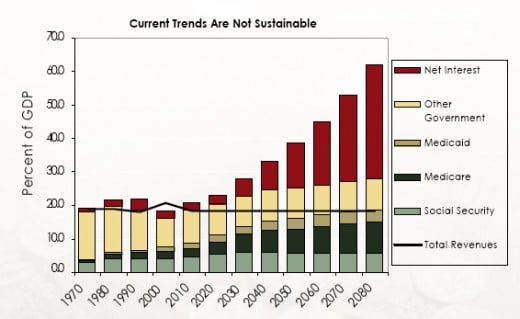

Leading economists suggested that the global economy would shrink by nine percent for the 2009 period and it did, but a little less than that. Some people say that the environment will benefit from less carbon addition as a result. At the same time, the poor suffer ever more deprivation due to a fall off to charitable contributions and loss of low end jobs internationally. In the US alone, sub-prime mortgage defaults and foreclosures show signs of affecting some 62 millions directly and indirectly before it is all over.

In the midst of all this, the war went on as usual in the Mid East with barely a hiccup. In Fact, Barrack Obama committed some 21,000 additional new troops for Afghanistan even in the midst if the worst of the meltdown. There have been massive bailouts and into 2010, we are learning that there will be little more in the months ahead. Meanwhile, the Us is in debt deeper than any other time in history.