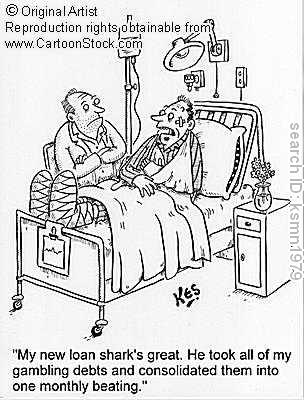

Loan Shark

With the failing economy, comes the emergence of the modern loan shark.

Exploitation of Beggars, Handicapped & Seniors

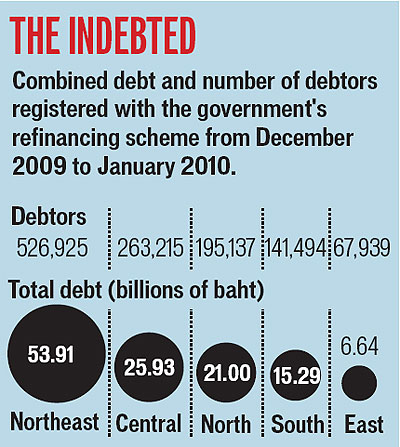

There is a person who extends loans to the poor and needy in Vancouver, such as those on a fixed income on welfare, are handicapped or on pension. This is our local version of micro loans and it makes us wonder if a similar thing is going on elsewhere in the world, at least in the way it's being done locally. A certain person who must at this time, remain unnamed obtains loans on the street from an individual who is in a position to lend money and the rate of return by welfare Wednesday on a $20 dollar loan is $35. This is an interest rate of 75 % per month loans to those on fixed incomes. This works out to 900% per year. The last time we looked, this was illegal. As there are many people in difficult financial circumstances as evidenced by the working poor who get payday loans, there are plenty of street loan sharks out there “servicing” those even lower on the scale than the working poor. The going rate in banks for credit cards ranges between 9% to 19% and up to 29% on other loans. The more of a credit risk you are and for store specific cards, the higher the rate. This same loan shark we are aware may borrow large sums from the bank at lower interest to recycle at the much higher rates back to themselves from the down and out. It is more likely that there is a “slush fund” savings account earning interest at the bank from which money is taken out temporarily and loaned at much higher interest in a one month turn around. If this is the case, this loan shark is winning two ways; at the bank and much more on the street. This is going on in Vancouver, BC and it's likely going on in a neighbourhood near you.

This phenomenon has likely existed for some time with all the cut backs and deregulation. Every now and then, government hacks like the NDP claim something should be done about excessive bank charges and interest and after that, the issue dies before it even gets to the table in parliament for discussion let alone legislating. As a result, a whole underworld of loan sharking has resurfaced. There are many types of this activity ranging from that practised in gangs to the down and out loaners of last resort on the street, such as we are dealing with in this and follow up pieces.

Often, people who are down and out, like the homeless and those on provincial handicapped pension, CPP, Canada pension, and the like find it hard to get money for one emergency or another, especially from any legitimate financial institution. The working poor often rely on payday loans from Money Marts and the like at higher interest over the short term of a two week roll over, but even this amounts only to about 10% on the loan. But nothing can compare to a 75% monthly interest charged by street scum loan sharks like a certain individual who has also been spying and harassing us for decades. The said loan sharking individual appears to be involved in many shady operations and was witnessed in a petty embezzlement by ourselves. That the system and justice system cannot or will not do anything about suggests that this is pervasive and out of control.

The loan period is based on the welfare cycle of one month and is payable on welfare Wednesday of each month at 75% interest. This same individual runs many such loans as far as we have been able to determine, but we do not know as to how many. We do know that there are plenty of customers on the street who need a short term emergency one month, small sum loan, whether for food, shelter or what may be needed. This loan shark who appears to have many connections from what we have learned over the years and as a result, has considerable influence, has a wide clientele base as he is often seen relating to many in desperate circumstances.

At the last BC and city government estimate, there are some 6,000 homeless people in the Greater Vancouver Regional District (GVRD). There are far more people who are physically and mentally challenged and even more pensioners, some of whom rely on such measures as all else is closed off due to austerity and cut backs. This drives some of them into the hands of this scum bag loan shark who is getting increased business as a result. We have been close to witnessing one such transaction and were informed post situation of what came down. We will certainly be on the lookout and prepared to make a video. When more information comes to light and is collated with actual facts and figures, we promise a full exposure. In fact, research has turned up some proof of this kind of activity going on in the US.

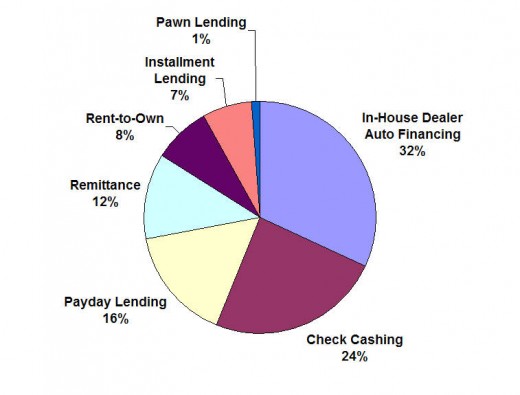

“Licensed payday advance businesses, which lend moneyat high rates of interest on the security of a postdated check, are often described as loan sharks by their critics due to high interest rates that trap debtors, stopping short of illegal lending and violent collection practices. Today’s payday loan is a close cousin of the early twentieth century salary loan, the product to which the "shark" epithet was originally applied, but they are now legalised in some states.

A 2001 comparison of short-term lending rates charged by the Chicago Outfit organized crime syndicate and payday lenders in California revealed that, depending on when a payday loan was paid back by a borrower (generally 1-14 days), the interest rate charged for a payday loan could be considerably higher than the interest rate of a similar loan made by the organized crime syndicate.” (1)

“Big banks that received TARP bailout money are funding payday lenders; companies Senator Dick Durbin termed "bottom feeders" and which charge high interest rates and fees for short-term loans, according to a report released Tuesday.

The banks, which include Wells Fargo, Bank of America and JP Morgan, currently provide roughly $1.5 billion in credit lines to publicly-held payday loan companies and between $2.5 to $3 billion to the larger payday loan industry, says the report, which was issued jointly by community group network National People's Action and non-partisan watchdog Public Accountability Initiative.

The payday lenders, including Advance America, Cash America and ACE Cash Express, which allow customers to borrow against future paychecks, and which, according to the report, charge an average interest rate of 455 percent on top of fees of $15-18 per $100 loaned, often depend on the big banks' financing for their business." (2)

"The very same banks that helped tank the economy and then needed hundreds of billions of dollars in taxpayer-funded bailouts are now aiding the bottom-feeders of the financial industry, as they seek the payday lenders to strip even more wealth away from everyday Americans," NPA executive director George Goehl, who also called payday lending "legalized loan sharking," said in a telephone press conference. "If Al Capone was alive today you might even get a better loan from him." (3)

Looking to Toronto, Canada, we see the practice going on here according to available news, at least as far as organized crime. “...in 2008, sources described Lu to the Toronto Sun as the largest loan shark in and around the Niagara Falls casino. Before legal casinos opened, he operated gaming houses in Toronto’s Chinatowns, police sources said. Lu was reported missing by his family to York Regional Police in December 2007 after he returned home from a trip to China in October, Vander Heyden said. Lu was last seen alive on Oct. 30, 2007. At the time, police said that that due to Lu’s “private nature,” his family wasn’t immediately worried by his absence...A police source told the Sun in 2008 that Lu claimed Niagara Casino as part of his underworld lending domain. The source said there was an agreement which allowed Vietnamese loan sharks. Lu was Vietnamese of Chinese heritage and a Canadian citizen to operate in Niagara while members of the Big Circle Boys, a Chinese gang, focused on gamers at other casinos.” (4)

References:

1. http://en.wikipedia.org/wiki/Loan_shark

2. James, Stephen (19 July 2001). “The ancient evil of usury”. Sacramento News & Review (Sacramento, CA)

3. http://www.huffingtonpost.com/2010/09/14/payday-lenders-banks_n_716246.html

4. http://www.torontosun.com/news/torontoandgta/2010/05/25/14086526.html

Many desperate people are now turning to legal loan sharking in the UK

- BBC News - Millions turn to payday loans, insolvency experts say

Millions of Britons are likely to take out a high-interest loan in the next six months to last them until payday, a group of insolvency experts claims.